That’s part of negotiation and compromise. But we also see conditions, specifically as it relates to pricing of leads, where the desire for a guaranteed price — a fixed cost per lead — creates great inefficiencies. Inefficiencies for both sides.

A year ago, research showed us that lead buyers thought that nearly half of all the leads they buy are overpriced. That’s an ungodly ratio. And that perception fuels a desire for a better price, which is most often met with an equal and opposite reaction from the supply side.

The resulting volatility in performance is damaging and completely unnecessary. Just because you’ve aimed for a fixed price, not fixed results (for both sides). But it doesn’t have to be that way.

Enter dCPL. The dynamic cost per lead. It transfers the focus of the transaction from the input (a lead), to the result. For buyers, that’s a new customer. And for publishers, that’s optimizing monetization of their inventory.

This isn’t a totally new concept. It’s been around for quite a while, actually. Display advertisers have used it for more than a decade. They just call it dCPM, since the CPM is their metric. Impressions. There’s also the dynamic CPC (cost per click) in the works from Google, Facebook, and the major ad exchanges.

These buyers and sellers have successfully moved the focus from front end cost (of an impression) to back end result (client CPA). It’s the path to both optimization and scale for buyers and sellers alike. So why is there so much fixed CPL?

For lead generation, the time is now to adopt dCPL. All the information and data that’s needed to deliver is there. It’s just about connecting the dots. Buyers know which of their sources are performing best by monitoring CPA. They know which individual leads convert from their CRM. By connecting the dots between their desired result (customers) and their investment to get them (lead buying), it simply becomes a question of working together with publishers for a shared — and better — outcome.

Here’s how it works:

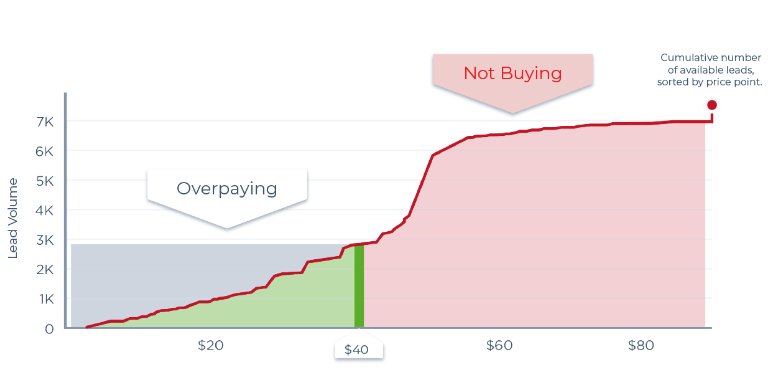

The exact price here, though, is not important. What’s important is that it’s fixed. That means that the buyer is going to be paying too much for many of the leads purchased. And the buyer is not going to have access to many of the leads in that would be available. To this buyer, they’ve overpriced. This buyer fixed his price at $40.

That’s too bad. Because the smarter lead buyer would have embraced dCPL. That buyer would be basing decisions on a fixed CPA — and then paying a dynamic price for leads while trying to reach that CPA.

Applying a dCPL model:

And that dynamic CPL does many things.

- It right-prices the leads in blue. The buyer pays real value for the leads that may be less desirable — or less likely to convert.

- It allocates those cost savings to acquire more of the leads in green. These are the ones that are more likely to convert.

- It enables the buyer to buy about 2-3x more leads overall, by paying the right price at every point on the curve.

- And in most instances, this is how a buyer is able to reach (or improve on) their target CPA goals.

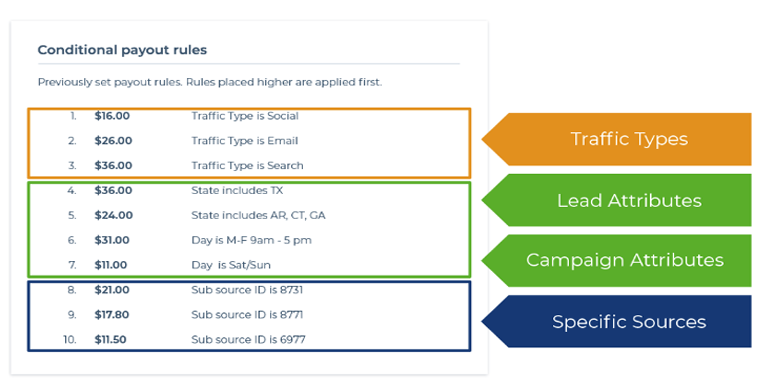

At PX, we call this pricing for both performance and for opportunity. A buyer’s primary objective is to maximize their opportunity while maintaining consistent ROI performance and efficiencies. Multi-layered pricing (the dCPL) does just that.

Why it works:

This is where “transparency” comes to life, and the sharing of knowledge that we described earlier begins to eliminate the tension between buyers and sellers.

It’s a Huge Benefit for Publishers

The simple beauty of dCPL for publishers is that buyers don’t simply negotiate for a lower price. They’re willing to pay higher prices when they know it’s warranted. But that’s only the beginning.

The greater beauty and benefit is that when you take away the buyer’s need and focus upon lower price, buyers will then manage the performance of their own campaigns! With this friction removed, it frees publishers to turn their head toward other things. Their focus can be more strategic: finding the right audience; making their media buys more efficient; and ultimately, better monetizing their audience.

In addition, when you add dynamic lead pricing, buyers no longer need to filter. The idea of day-parting becomes obsolete, because buyers can price to performance. Running lead campaigns over the weekend? Easy, with the right pricing in place!

Budget restraints and caps on campaigns are removed, because the efficiency is already built in. And instead of getting zero budget from buyers on some leads, publishers can get some budget for every lead across their spectrum.

And that’s huge!

The impact of dCPL on lead buyers and publishers

The core objective when it comes to lead buying is growing a customer base. Today’s leading edge media buyers are applying dynamic pricing to their campaigns. Media buyers who are active in search, social, email, and on comparison review sites are using the model to grow their business.

And they are winning! Data shows that when buyers deploy dynamic pricing, they consistently and significantly GROW their volume with their publishers, because their campaigns with those publishers go uncapped. Good for the buyer… and good for the publisher!

Conclusion

Dynamic pricing has been adopted by just about all other sectors of digital marketing. It reduces friction between buyers and sellers, and it delivers to both parties better performance and more scale. Less friction means less restrictions; greater transparency; more trust; alignment between parties. And success for both. That’s our goal.

And that’s all because of the dCPL. Don’t you love it?